For most people, retirement seems like it will never happen due to the time seeming so far off. But the truth is, life goes by in the blink of an eye and before you know it, you’ll be almost 65.

It may seem daunting to think about retirement when you just graduated and are -perhaps- saddled with student loan debt. Or your job prospects aren’t as good as you thought.

However, retirement planning in your 20’s gives you something very powerful.

Time Is On Your Side

When you’re in your 20’s, you have decades before you retire -unless you’re aiming for FIRE-.

These decades will bring compounding, which is a very powerful financial tool.

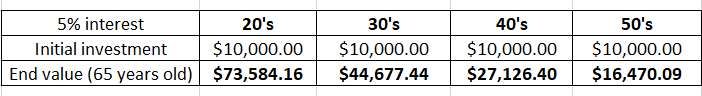

Let’s take a very simple example of savings $ 10 000.00 at 25, 35, 45 and 55. The yearly interest rate is 5%. You never add to it and cash-out these savings when turning 65.

As you can see, the difference in end-results is staggering, even in the 30’s decade.

The sooner you start saving, the better off you’ll be, even if you only save small amounts at first.

Higher Tolerance to Risk

When you have decades before needing your retirement money, you can invest it and take a bit more risks, potentially reaping huge rewards. This is in relation with the above point.

Historically, the stock market’s returns have always outperformed the returns of traditional savings accounts, GICs, term-deposits and real-estate.

Your saving strategy should always be aligned with your risk tolerance. Retirement savings is a long-term plan that you should not change when you get scared or when the stock market is bearish.

Tips to Get Started

Pay Yourself First

Automate your retirement contributions and link the dates to your pay checks. Set an amount and pay yourself before paying anything else.

Use The Right Account

In Canada, the best vehicles to save for retirement are the RRSP and the TFSA. If you earn less than $50K gross, it’s best to use a TFSA.

Find An Employer that Offers a Pension or a Group RRSP

The best way to have a comfortable retirement is to have your employer help you save for it. Pension plans are becoming more elusive in 2023, but they still exist, primarily in government or unionized sectors.

Group RRSPs are more common. A group RRSP is an employer-sponsored plan that allows eligible employees to contribute to their retirement savings while benefiting from more competitive management fees, as well as employer’s matching contributions -in most cases-.

An employer’s contribution is free money to you.

Increase Your Contributions as You Earn More

As your income increases, so should your retirement savings contributions. Making a habit of upping your savings will help you to stay ahead of inflation, and keep you on track to avoid a retirement saving shortfall down the road.

The same applies if you receive a bonus, a tax refund or other windfall money. Save a chunk -or all- of it to your retirement account.

Think About Your Spending Needs in Retirement

You may not be able to transport your mind to what it’s like being 65, but you can assume that you’ll need money for housing, food, medicine, transportation, and the everyday basics. If your home is paid for, you may spend less than if you had a mortgage or a rent, for example.

Find Your Retirement Number

Once you know what you spend, use a calculator to determine what you’d need to live the same as you do now, based on data that estimates inflation rates and costs in the future.

This number will probably change a few times, as your life unfolds.

Expect The Unexpected

Always build in a little cushion in case of something unexpected happens. What if you plan to retire at 70, but you end up with a disease at 50 and have to retire? If you stayed on the plan you have now, what would you have to give up?

Final Word

Everyone has their own idea of what kind of retiree they want to be — world traveler, leisurely golfer, senior citizen who walks around parks befriending pigeons — but one thing is consistent: none of those options, even the last one, is possible without a steady, healthy cash flow.

The good news is that in your 20’s you’re ahead of the curve. You don’t have to put away half your pay check every month to ensure you’ll be comfortable in retirement. Start small and prepare to marvel at how it all adds up.